Growing Up Union

Kevin Collins has been active in the union movement nearly his entire life. After an upbringing spent attending union events with his father in the Washington, D.C. area, Collins kicked off a long career working for and serving organized labor. Now the VP of Market Development within Ullico’s life and health insurance carrier, The Union Labor Life Insurance Company, Collins’ focus is highlighting the importance of supplementary insurance for union families. In a recent Q&A, Collins spoke about how his late-father’s career inspired his own path in the union world and how his eventual passing made the topic of life insurance personal for his family.

What brought you into the world of organized labor?

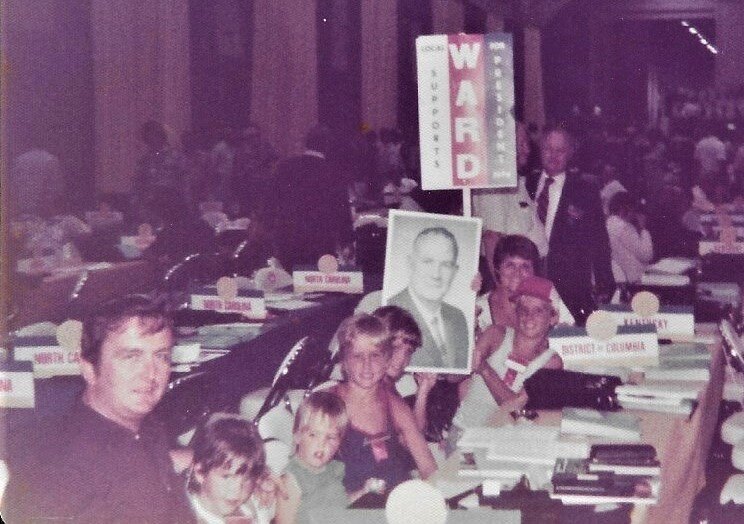

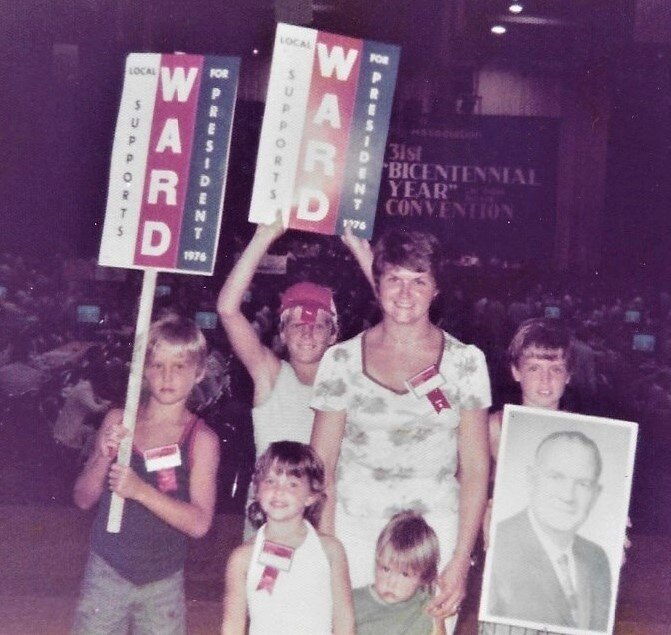

I have always said I was born into it. My late father was a union plumber with Local 5 here in Washington, D.C. When I was 7-years-old, he was elected as the assistant business manager of Local 5. Then, from 9-years-old until my senior year of high school he ran the plumber’s union in D.C. as the business manager and Financial Secretary-Treasurer.

Growing up in the union world certainly shaped my upbringing. As one of 5 kids, I always joke that my family went to every union picnic they could—not just the plumber’s union picnics. We would visit with folks from Local 5, but also Steamfitters 602, Sprinkler Fitters 669 and other building trades unions.

Wow—so your father’s career got your whole family involved in the labor world. When did you start becoming active in the movement?

I graduated from high school in 1985 and over the summer I worked as a plumber’s helper for the union. I worked that job during the summers throughout college and really appreciated the opportunity.

Around the time of my high school graduation, my father received his appointment to the international union as an international rep. His first assignment was in the political department as a lobbyist. I started college at the University of Maryland and to make a little extra money I spent my Christmas breaks working with the building engineers at the United Association (UA) Headquarters—washing dishes in the cafeteria and cleaning the office.

During that time, I got to meet a lot of folks that my father worked with and began to understand more of what he was doing on the political side. When I had the opportunity, I joined him in D.C. for fundraisers and got to meet some of the other lobbyists for the trade and craft unions. That experience inspired me to major in Government and Politics.

So your father’s work as an international rep inspired an interest in the politics of the union movement. What happened next?

Coming out of college, I worked for a couple of local political campaigns for labor-endorsed candidates. Through that work, I met a guy by the name of John O’Connor who was the Secretary-Treasurer with the Washington, D.C. Building and Construction Trades Council. John offered me a job as their legislative representative handling lobbying activities in Annapolis.

It was a lot of responsibility for a 23-year-old, but it gave me an opportunity to learn from all the leaders in the different building trades unions. Coming from a UA background, it was incredibly helpful to learn about the priorities of each international union within the building trades.

That position set me up for a long career in this field. I’m a 32-year union member and I’ve spent my entire career either in labor or working to serve labor.

Thanks for providing that rich background. You’re now working with The Union Labor Life Insurance Company. What are some trends you are seeing in the insurance field?

The trend that I’ve seen the most with our clients is a heightened interest in the availability of supplemental benefits. I think our own marketing has helped bring awareness to the fact that many individuals in this country, including union members and their families, are uninsured or underinsured.

The Ullico mission has been to raise awareness about the importance of having supplemental coverage. We want to demystify the process for getting covered and counter the idea that it’s unattainable. We also want to show people why it’s necessary, because this kind of insurance can have a tremendous impact on families.

My own father passed away at 55 and life insurance was a huge benefit for my mother. Naturally, my siblings and I were concerned about her financial well-being. She was the CEO of our home and proudly spent her time raising 5 children, but the family income stream was from my father’s job. We knew that she would maintain a monthly survivors benefit from my father’s pension—there is nothing better than the negotiated benefits that a union job provides. What we didn’t know at the time was my father did have a life insurance policy from his employment at the UA. That tax free lump sum benefit provided an additional layer of financial support for my mother. Ultimately, the defined benefit pension supplemented by a life insurance policy meant she didn’t have to worry about her ability to pay for any unforeseen home and living expenses.

It was a comfort to everyone knowing she could count on being able to live her life with dignity. I’ve always said that it’s not just about money—I’d cash in everything to have my father back—but it is about securing the financial health of the loved ones left when the wage earner passes on.

Thanks for sharing that personal story. It really does put things in perspective.

In closing, I like to ask people about an important lesson they’ve learned over the course of their career. What is something you’ve learned?

The first thing anyone told me when I went down to Annapolis representing the Building Trade Council was “your credibility is the most important thing you have here. Once you lose your credibility, you’re basically done.” If someone thinks you lied to them and you lose their trust, it just becomes far more difficult to make progress. So, I’ve found that credibility is key in building and maintaining long-lasting relationships.

This conversation has been edited and condensed for clarity.